Rapido, a mobility startup has turned unicorn with a $120 million Series E funding round backed by its largest backer WestBridge Capital which has pumped in money via three different investment vehicles.

The board at Rapido has passed a special resolution to allot ten equity shares, 95,479 Series E and 95,489 Series E1 compulsory convertible preferred shares (CCPS) at an issue price of Rs 52,467 per share for a consideration of Rs 1,002 crore or $120 million, as per the report.

WestBridge has infused the amount via Setu AIF Trust, Konark Trust, and MMPL Trust, according to the filings.

Rapido raised $180 million in a Series D funding round in the month of April 2022.

Westbridge is the largest stakeholder in Rapido with 26% stake. It’s worth noting that Swiggy which owns over 15% of the company didn’t invest in the new round as it already filed DRHP for a potential IPO.

Rapido also claimed to have left Ola behind and became the number two player after Uber in the overall ride hailing space (bike, auto and cabs).

As of March 2024, Uber processed 19.3 lakh rides on a daily basis, while Rapido did 16.5 lakh rides a day, and Ola at 13 lakh rides.

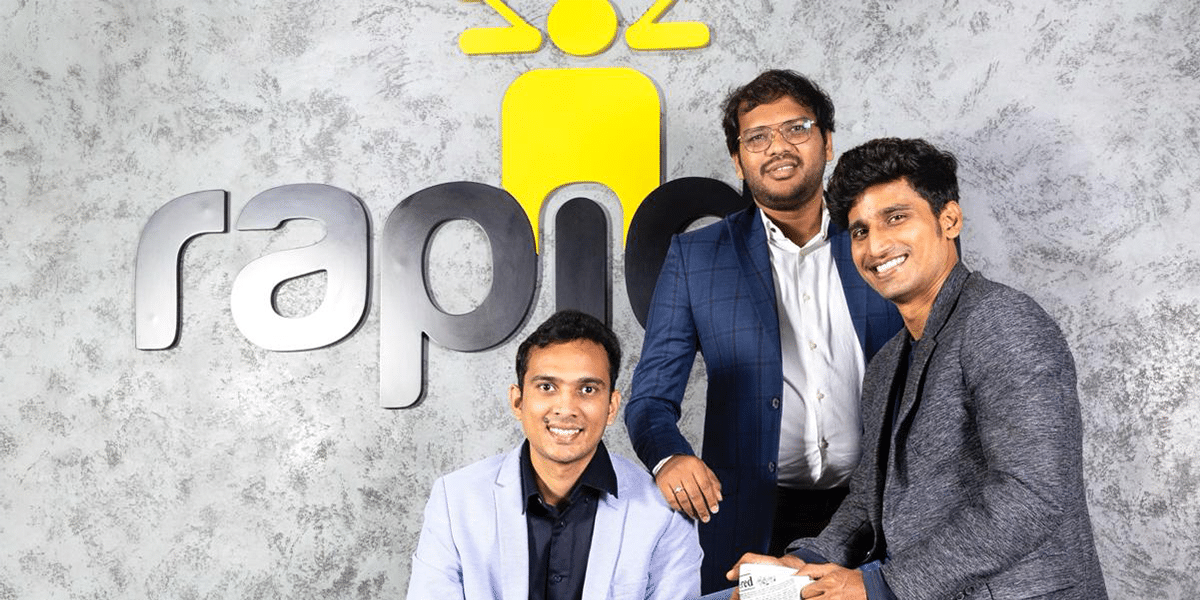

Started by Arvind Sanka, Pavan G and Rishikesh SR in 2015, The SaaS play (zero commission model) by Rapido along with cash backs and IPL spending appears to have been paying off well for the company. As per its documents, Rapido has emerged as a leader in the bike taxi space in the country while it dominates the southern part of the country in the auto-hailing segment.

Meanwhile, ET reported that Rapido is in talks with investors to raise another $20 Mn. “A US-based family office and a UK-based fund are in talks to pick up stakes in the company,” a person aware of the matter was quoted as saying.

The fundraising also comes at a time when the bike taxi segment is facing regulatory hurdles in key markets such as Karnataka and Delhi.