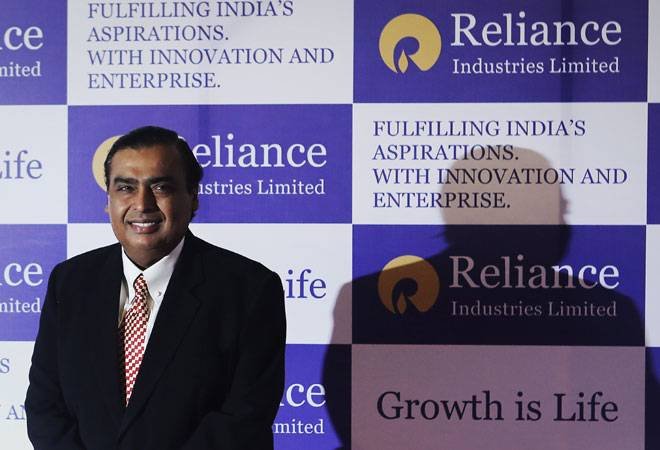

RIL turns into the first Indian Company to hit $200 billion market cap.

Reliance Industries grew to become the first Indian employer to hit $200 billion market cap on Thursday thanks to a spate of investments in its subsidiaries, which have pushed its share expenses higher.

Shares of telecom-to-oil principal jumped over 6 per cent on BSE to a clean report excessive of Rs 2,343.90. That ability its market capitalization rose to a document Rs 14,14,764.90 crore or $192.85 billion.

The partly paid up shares of the corporation additionally spiked almost eight per cent to new document excessive of Rs 1,365, which interprets into the m-cap of Rs 57,815.36 crore or $7.82 billion.

In total, the market values the enterprise at $200.68 billion. This is about twice the dimension of the subsequent largest Indian firm, TCS, which is valued at $119 billion.

The shares of the organization have received a carry from a variety of bulletins of funding in Reliance Retail.

Silver Lake already stated it will announce Rs 7,500 crore whilst reviews stated Saudi Arabia’s Public Investment Fund (PIF), Abu Dhabi-based Mubadala Investment Company, Abu Dhabi Investment Authority (ADIA), L Catterton, and KKR are in all likelihood to choose up stakes in the retail task as well. They had additionally invested in Jio Platforms.

Investors lapped up shares of the employer as non-public fairness massive Silver Lake Partners receives equipped to make investments Rs 7,500 crore in Reliance Retail for a 1.75 percent stake in the company’s retail unit.

Investors see it as a signal of the commencing of some other spherical of investments.

The oil-to-telecom conglomerate is increasing its retail commercial enterprise and lining up a posse of international buyers to take on competitors such as eCommerce massive Amazon and Walmart-owned Flipkart in India’s fast-growing on-line retail business.