For years, the Indian credit card landscape was defined by a familiar hierarchy. At the base of the pyramid sat entry-level cards like HDFC Moneyback+, designed to lure first-time users with modest rewards and the promise of building a credit footprint. Higher up the chain stood lifestyle-focused and premium offerings, boasting flashy perks but catering to a relatively narrow base of affluent spenders. But with fintech challengers like Jupiter stepping into the fray, this ladder is being disrupted. Their Edge+ card doesn’t just mimic bank-issued plastic—it reimagines it for the UPI age, positioning itself as a daily driver for millennials and Gen Z who live online and transact everywhere through their phones.

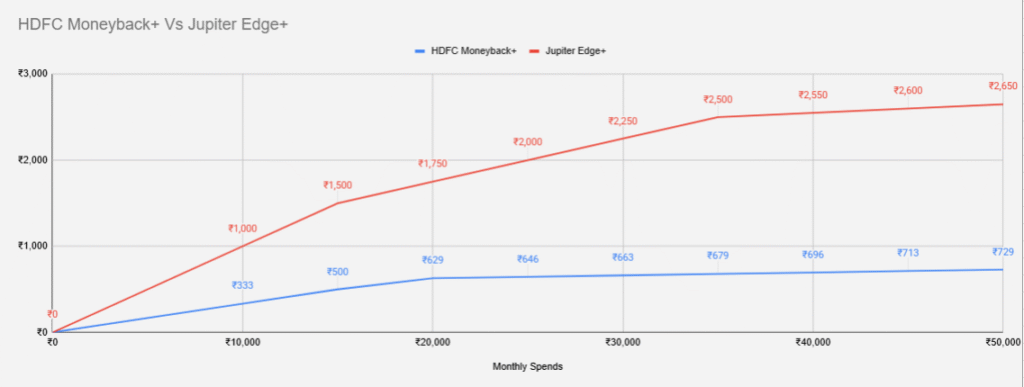

A look at the numbers tells the story clearly. On a monthly spend of ₹10,000, HDFC Moneyback+ generates roughly ₹333 in rewards, while Jupiter Edge+ returns a cool ₹1,000. At ₹25,000, the gap widens dramatically: HDFC caps out at around ₹646, whereas Jupiter delivers ₹2,000. And even at higher spends of ₹40,000 to ₹50,000, Moneyback+ can barely push past ₹700 in rewards, while Edge+ comfortably sits above ₹2,600. The contrast is stark: HDFC’s card provides an effective cashback rate of barely 1.5% at higher spends, while Jupiter touches 5% and beyond—though with caveats. This isn’t simply a matter of numbers. It represents two fundamentally different philosophies about what credit cards should be in India today.

Key Contrasts at a Glance: Monthly Spends vs Cashback Money

| Spends in a month | HDFC Moneyback+ | Jupiter Edge+ |

| ₹0 | ₹0 | ₹0 |

| ₹10,000 | ₹333 | ₹1,000 |

| ₹15,000 | ₹500 | ₹1,500 |

| ₹20,000 | ₹629 | ₹1,750 |

| ₹25,000 | ₹646 | ₹2,000 |

| ₹30,000 | ₹663 | ₹2,250 |

| ₹35,000 | ₹679 | ₹2,500 |

| ₹40,000 | ₹696 | ₹2,550 |

| ₹45,000 | ₹713 | ₹2,600 |

| ₹50,000 | ₹729 | ₹2,650 |

- At ₹10,000 spend: HDFC Moneyback+ → ₹333 vs Jupiter Edge+ → ₹1,000

- At ₹25,000 spend: HDFC → ₹646 vs Jupiter → ₹2,000

- At ₹50,000 spend: HDFC → ₹729 vs Jupiter → ₹2,650

- Effective cashback rate: HDFC ~1.5% vs Jupiter ~5% (before category caps)

HDFC’s Moneyback+ remains a traditional entry-level product. It appeals to first-time credit cardholders who want a straightforward introduction to rewards without complicated structures. The cashback is conservative, and much of it is delivered in the form of “cash points,” which often require redemption through specific channels rather than instant statement credits. That alone creates friction, and for a generation accustomed to instant cashback notifications on apps like Amazon or Swiggy, the delay dulls the appeal. Its real advantage lies in accessibility: HDFC, being India’s largest card issuer, can cross-sell this product to millions of existing account holders. Many consumers don’t apply for Moneyback+ because it’s the “best” card, but because it’s the easiest one to get approved for.

By contrast, Jupiter Edge+ feels like a card built to weaponize UPI. Structured with aggressive multipliers: 10% on shopping (up to ₹1,500 per month), 5% on travel (up to ₹1,000 per month), and 1% on all other categories. It rewards the kind of routine payments that younger Indians already make daily. By allowing linkage to UPI apps, it integrates directly into the country’s fastest-growing payments rail. In practice, this means a consumer can use Edge+ to pay for everything from an Ola ride to a roadside chai through their phone while still earning cashback. HDFC’s Moneyback+, rooted in the traditional POS and e-commerce model, simply doesn’t operate in the same orbit.

Strengths & Weaknesses in Snapshot

HDFC Moneyback+:

- Easy approval, good for beginners building credit

- Trusted HDFC brand, bundled with salary accounts

- Very low cashback (~1.5% at best)

- Cashback via “cash points” with redemption restrictions

- Not future-proof: no UPI integration, outdated rewards model

Jupiter Edge+:

- High multipliers (10% shopping, 5% travel) before caps

- UPI-native, built for mobile-first spending

- Extra perks (Amazon Prime, OTT, dining trials)

- Cashback capped—effective rate drops for very high spenders

Yet, Jupiter’s model is not without its red flags. The dazzling cashback numbers in the mid-spend range are only possible because of caps. Once a user exhausts the ₹1,500 shopping and ₹1,000 travel limits, incremental spending earns a flat 1%. That makes Edge+ unbeatable in the ₹10k–₹25k band but less exciting for big spenders. A consumer spending ₹1,00,000 a month would still max out at about ₹2,650 in rewards—an effective cashback rate that collapses to 2.6%. In contrast, SBI Cashback or Axis Cashback Credit Cards, with their flatter reward structures, might deliver more consistent returns at higher volumes. Jupiter’s appeal, therefore, is laser-targeted at middle-class digital natives who shop online and travel modestly but regularly.

Another key difference lies in perception and sustainability. HDFC, with decades of profitability, designs Moneyback+ as a conservative entry point, where rewards are a fraction of interchange fees. Jupiter, on the other hand, is a fintech challenger still focused on customer acquisition. Subsidizing 10% cashback—even with caps—raises the question: is this sustainable long-term or just a loss-leader to onboard users into Jupiter’s larger ecosystem of financial products? If investors demand profitability, those cashback caps could shrink further, potentially leaving customers disappointed. For HDFC, slow and steady wins the race; for Jupiter, speed and flash are the strategy.

From the consumer’s perspective, the choice boils down to intent. Someone fresh out of college, applying for their first card, might value HDFC Moneyback+ not for its rewards but for its ability to build a credit score with a trusted institution. Meanwhile, a 25-year-old professional living in a metro, already transacting on UPI and shopping online frequently, would find Jupiter Edge+ dramatically more rewarding for their lifestyle. The psychological pull of “instant” cashback, especially when tied to familiar apps, cannot be understated.

The Verdict

- HDFC Moneyback+: A conservative, trust-driven starter card for first-time users. Reliable, but underwhelming on rewards.

- Jupiter Edge+: A digital-native disruptor, far more rewarding for everyday shopping and UPI-linked use, though capped and possibly unsustainable long-term.

In short: HDFC Moneyback+ is where many Indians start their credit journey. Jupiter Edge+ is where the new generation wants to go.